Truth and Beliefs about Debt: No, We’re Not Going to be Enslaved by China

Subscribe Today!

There’s a prevailing belief about debt that if you’re steeped in it, it’s a bad thing. Bill Stierle and Tom discuss how this belief may be true for personal debt, but that’s not necessarily true for business debt and government debt. Businesses and governments often have to get into a lot of debt to get the economy running – producing businesses and creating jobs. Large companies like Amazon and Uber took on a tremendous amount of debt before they started hitting gold. In this episode, Bill and Tom discuss the different levels of debt, why we should know how the different levels of debt work differently, and how the rumor that we’re going to be enslaved by the Chinese because of the national debt is nowhere based in truth.

---

Watch the episode here

Bill, it’s interesting how so many people have different perspectives about a topic, especially a financial topic. When we look at the language communication being used around that topic from different perspectives at different times, it does reveal a lot. Doesn’t it?

It does. It tips the hand of somebody’s belief, bias, or perspective about different subjects, whether it’s government perspective, business perspective, or personal perspective. This is the way I believe the world to be or this is the way my parents believe the world to be. “If you just do this thing, your life is going to work out great. If you do it this way, that is clearly the best way to do it.” Meanwhile, we could be operating with some beliefs that are not as effective, helpful, or even truthful, which is something that we want to poke a stick out a little bit so that we can have some honesty about what some of the truth perspectives are.

We’re in the financial world and what we want to talk about is debt. The whole concept of debt, the reality of debt, and there are several different levels. There’s personal debt as an individual or maybe as a family. There’s business debt if you’re in business and how that might be is. We also have in our country a national debt. Those are very different things. I think we should touch on each of those.

The challenge is to start slowing down or separating the narratives since those are very different things. A credit card debt is different than a debt that you own for your house. They are similar in their functioning, but there are differences.

I would also add into that an automobile loan, perhaps your car. There’s a difference there. People sometimes don’t realize that it’s very easy in general. Even if you don’t have a whole lot of income, it’s pretty easy to get a car loan because there’s an asset against it. That’s a big difference between what you first mentioned, which was a credit card bill. If you don’t pay the car loan for enough months, eventually, the lender is going to come, take the car away, and sell it to somebody else.

That’s why it’s easier to get a car loan because there’s an asset against that they can take back and recover any loss they might have had as a lender. Wasn’t it during COVID? I remember that automobile companies were not only offering zero-interest loans to trying to get people to buy cars when times were slow. I think they’re still doing some of that now. They also were offering, “If you lose your job, you can turn the car in and no harm, no foul on your credit type of thing.” There were some of those programs.

Being able to provide support, the folks in the financial world have done a pretty good job of setting up a system so that people are on the brink of being stretched a little too much. People push themselves there too with their own mindset or American optimism that, “I’m always going to have my job. I’m going to always have work. I always get paid, what I’m getting paid and more.”

Meanwhile, a lot of that stay-in-your-job economy has shifted over the years but the beliefs and biases have not caught up to the person’s worldview. The job that you had at age 20, 25, or 30, you couldn’t make it now with the things that you have at your age.

No one ever talks about, “Every year, you’ve got to keep up with this inflation thing and the way the economy is moving.” That is unsettling because most people being stressed the way they are don’t have time to do the things that would foster a healthier society, whereas our parents’ generation had more time and energy because they weren’t too stressed regarding money. They were stressed, but not the way it is now. Back then, they were stressed when there was one breadwinner, the wife stayed at home, and they had enough money to make it work. They also had time and energy to contribute to the community, kids’ Optimists Leagues, community parks, go out on Sunday, and relax.

I don’t remember the last time I did that with the family picnic and do downtime, which is something that in our society, there’s not a lot enough money around to take time off, take a vacation, or you got to have two jobs to make it work. There are two people, husband and wife, both doing two jobs in order to keep up with the economy and work. The beliefs and finances have changed around the economy and the work number. It’s unsettling. Debt is something that people walk themselves into because they’re thinking, “This should be different. I’m working hard. Isn’t that going to turn around?” The answer is, “No, not if the wages get stifled or depressed. It’s not turned around anywhere.”

People’s beliefs around debt are quite varied. Some people are like, “I want to take a vacation. I don’t have the cash now. I want to go to Hawaii for a vacation for a week. I can get a credit card and use that credit card to go on vacation.” That’s true. You can, but just because you have that credit, does that mean you should use it on something like that? You’re going to be paying that off potentially for a long time.

In the context of COVID and so many people losing jobs who depended on their weekly paycheck, especially in the restaurant and travel industry, they had to turn to debt and credit cards for basic necessities of life, by putting food on the table for their family, paying for medicines, doctor’s visits, or who knows what? That is going to have a negative impact because you run up all that debt. You owe that money. You got to be paying a lot of interest. It’s hard to get out of that hole. Plus, it impacts your credit scores, which has a huge impact on your ability to be able to do other things like getting that car loan or renting an apartment. They look at your credit scores and the amount of debt you have when you apply to rent an apartment or a home.

The truth perspective that we’re talking and poking at is, “What if a human being doesn’t have that same mindset around money?” Their mindset around money is, “How about if I just run up a bunch of debt, start a business, and pay employees and then in five years or whatever, close the business and do out or cash out or even let go of, ‘This thing failed? Sorry, banks. You guys are stuck with the debt because I took my best shot and you loaned me the money, but I was not able as an entrepreneur to carry it out.'” The company files for bankruptcy. The individual starts and does it all over again and borrows more money because they’re a person who is used to the practice of borrowing money, having debt, and moving money around the way they do it.

That is unsettling because if we are not fiscally responsible but yet claim ourselves to be fiscally responsible, then all you’re doing is letting somebody else deal with the wreckage or what people say the garage sale of a company closing. It’s like, “There are 40 chairs over there. How can I get $0.25 on the dollar or $0.10 on the dollar for the chair that I bought for all the people in this call center that’s closed down?” It is a different mindset. What winds up happening in the business world is played one way. Amazon, Uber, and all those big companies took on a tremendous amount of debt before they got started and started hitting gold. They had to scale to a certain volume for them to get the chunk of change.

The investors would go like, “Yes, we’re betting on you, guys. We’re going to throw money at you. We’re betting because we think 5, 7, 10 years from now, you’re going to give us a whole bigger chunk of change back and payouts.” It’s very valuable because that’s what those people spend their time thinking about. Most people do not spend time thinking about that. That’s the difference between a Wall Street mindset and a Main Street mindset. They’re very different. It’s interesting because you and I have both borrowed money from friends, relatives, investors, and things in time. It is something to start shifting your perspective and the truth around debt, how to carry it, how to tolerate it, and not letting that mindset ding your decision-making or the mindset of growth. It’s a lot better and easier.

Business debt is very different than personal debt, not only how people think about it, how they approach it, and the different beliefs around it. It is very common for businesses to borrow money to start up entirely. Other businesses don’t. Especially mom-and-pop businesses, might borrow a little bit of money or use their own savings to get started, then grow more organically and grow from sales of services or products. Most of the time, businesses need to go into that. It is a function of the business. It is one of acceleration because you have an opportunity that’s time-sensitive. You need more money to be able to keep up with growth or you need more money to be able to invest, whether it’s in tooling or manufacturing, something that you’re going to sell.

Amazon was notorious back in the early days in the ’90s when it started for not turning any profit. They went public relatively early in their history and kept selling more stock. People were buying stock and that funded the company. That’s a different debt. You’re going to have to pay dividends to shareholders eventually. If you don’t, your stock is going to go through the basement and your company is not worth much. It’s hard to function. Amazon for many years, same with Tesla, there are lots of companies like this that spent a lot more money than they earned for a lot of years before they turned profitable. It is a very common thing.

You’re right. I’ve had businesses where I had Angel investors that were friends and family back in the ’90s. That’s how we generated the cash to start the business that eventually was sold. Now, my current business grew more organically. We have got loans doing what is called debt financing, getting loans some from the SBA, some from other institutions, some from “investors.” They’re companies that lend money to businesses like mine to help them grow and they make interest on the money they lend us. That’s part of how we’re growing. You can get investors that you have to give away equity. There are all sorts of different ways, but debt is a very common thing for business.

That’s the challenge. If somebody is calling themselves fiscally conservative, they could possibly have the thought that debt is bad instead of, “This kind of debt is bad and this kind of debt is good.” They can’t draw the line between the word debt. They don’t know that there are two different types of debt. If I go into debt and build a factory, I have an asset now against that money that I borrowed, it’s not that I’ve borrowed the money and bought a non-tangible thing.

A big part of the difficulty in a consumer culture is that we’ll buy things that diminish in value instead of buying things that, “This is a conservative thing. I want to buy and pay for this thing that is not expendable. I want to build this bridge because the last bridge is falling down. I want to buy this bridge to have this asset around that our country, city and, economy need to run the truck over. This bridge has to go over this overpass.”

You’re talking about that on a different scale. That’s our government, whether states have their own economies and issues with debt or our national economy. You’re right. It’s very different. One example, I have a good friend of mine who is a doctor. She’s a chiropractor and a huge part of her business requires taking X-rays. She bought for $120,000 some new fancy X-ray thing because she’s a chiropractor. You want to get your upper cervical vertebrae, your neck, and your skull.

It has this thing where you just sit and it takes an X-ray going 360 degrees around you. It gives them a much better picture to be able to treat you properly. She borrowed the money to buy that X-ray. Now, the treatment that she’s able to give people is much better.

She’s able to charge them for that X-ray. They’re getting better results. This X-ray thing is going to be paid off in no time. That makes a lot of sense.

When you talk about a bridge like infrastructures, highways, or roadways, it’s harder to quantify the return on investment in the same way. That is why it becomes a different perspective for people to think about. We all want good bridges and roads to be able to drive on. I just drove from Colorado to California. It was a 1,100-mile trip. When I got back into California, I was like, “These roads in California are good.” They’ve been putting money into those roads and in certain parts of Utah, but in other parts of Utah along Interstate 70 going from East to West or West to East, those roads could use some help. They need some repair.

I’m sure lots of the bridges I went over were problematic and needed repair. We’ve touched on a little bit of this in our last episode. These types of things, it’s important to make an investment in our infrastructure in America. The way our government system, the only way to do that is for our legislative branch to appropriate the money to pass a bill that then spends it, but the government doesn’t have that money. Does it, Bill?

It is borrowing money from different sources. The number one source it gets its money from is Americans buying bonds in America. I don’t know what the percentage is offhand. It’s left me here.

I think at least 1/3 of the American debt is owned by Americans in the form of bonds. I believe that’s right. I could be off on that. We’ll check that.

The other one is, how about foreign countries? How much do they invest, gamble, and put their money in the United States? The number one debt person from the limited knowledge I know is Japan.

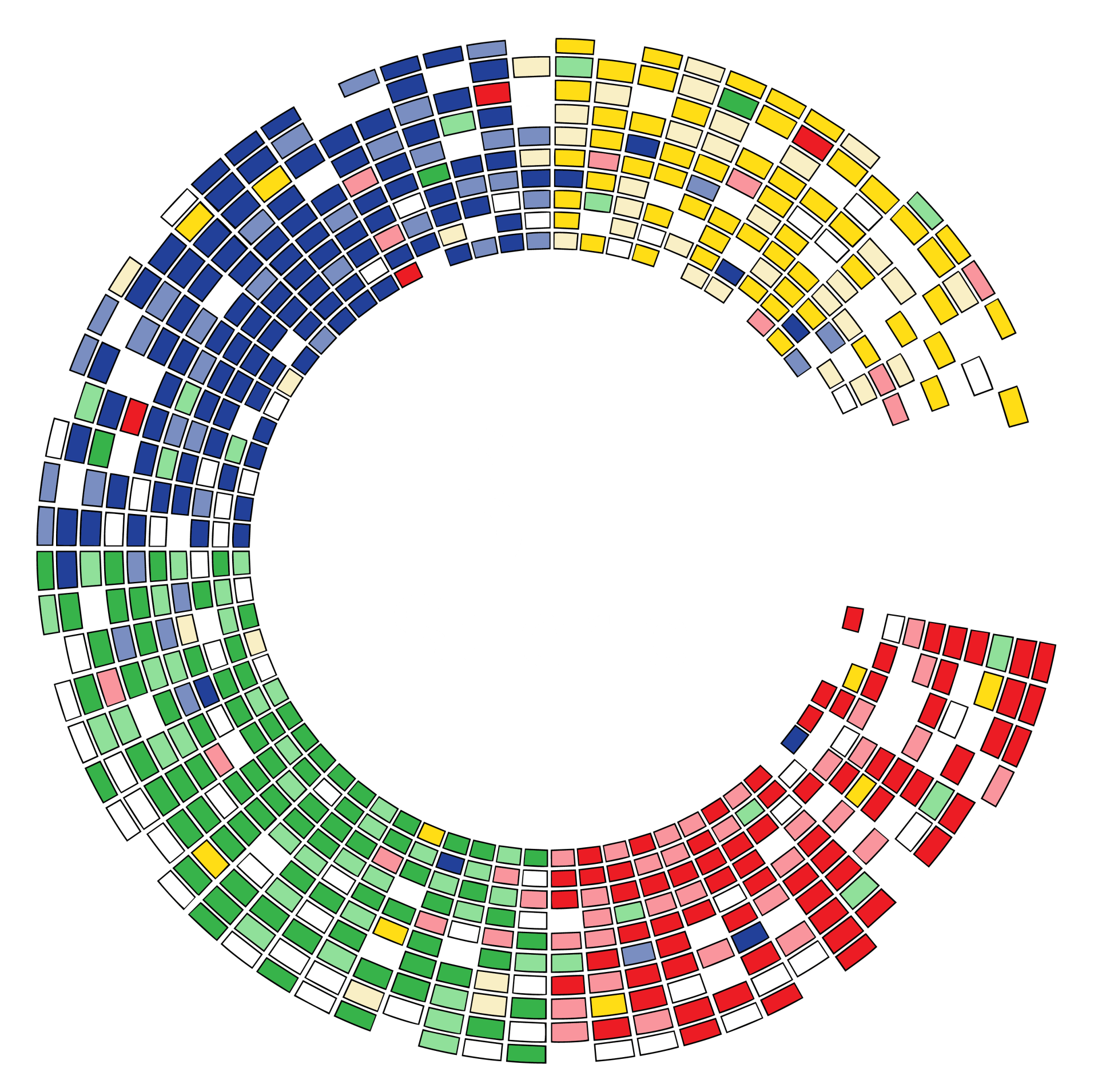

I’ve seen that, too. Japan is the number one holder of US bonds, but it’s still a small percentage of the total. People always talk about as China has risen that China owns more of America and is buying our bonds and debt, but China only holds about 5% of the national debt. It’s very interesting. We should share that John Oliver on Last Week Tonight did a whole report on our national debt.

There was a lot that he eliminated there that are pure facts. He also eliminated some things that are realities and some things that are beliefs that different people have around our national debt. It’s very illuminating to learn about our national debt because in America we are, a lot of times, driven to believe the national debt is bad.

That’s the thing to get ahold of. What are those different instruments? There are individuals who own Treasury securities. There are mutual funds, banking institutions, insurance companies, and different state and local governments. A third of it is foreign international and then that’s cut into, “What country owns the different ones?” All you got to do is start making up a belief that is partly true about China owning. America is like, “Really? How much?” It’s not that much as compared to everything. The debt is mostly owned by other Americans, other banks, and pension funds.

Pension funds’ investments and all sorts of different investment funds will invest in a mix of stocks, which are not debt at all. You’re buying ownership in a company for a helpful profit return or bonds, which don’t have as much of an upside return but are not near as risky. You’re going to have value there at the end of the day. You’re not going to have a company completely go under because it fails and then their stock is worthless. There are lots of different organizations, institutions, countries, and individuals that own a portion of the United States National Debt.

To me, what was fascinating as I was researching this to learn was that a lot of times, these messages that are put out about the national debt saying, “China owns our debt. We can’t let China keep buying more of our debt because when that bill comes due, we’re going to then owe China and be in trouble. China is going to be able to push us around and control us.” Those are some of the messaging around it that happens when people are trying to say, “National debt is bad. National debt that is owned by a certain country is bad.” The reality is there is no mechanism for that bill to come due. It’s not like, “If you don’t pay your mortgage for three months, they’re going to come and foreclose on you.” It doesn’t work that way.

It goes into restructuring. The debt is restructuring. That means it’s from an illusionary perspective places like, “We’re adjusting and changing it over the field of time.” It’s like, “You can make it up as you go and adjust it so that it’s going to work better?” That’s the thing that’s unsettling and disheartening. When we talk about the word truth, people are trying to influence our biases to get us to vote for things or our purchases in order for us to go on the credit card to buy that thing that they’ve so enticed us to buy. It’s like, “Wait a minute.”

There are different mindsets that work through this. Some people say, “Don’t spend unless you are spending from what you have available. Take risks with this percentage. Don’t take risks when you’re close to the bone. If you’re close to the bone, how the heck are you going to be able to swing for the fence?” Sometimes, you got to try to hit the home run. This is the foundation of gambling, penny stocks, and slot machines. Those are small, little gambles that are moving forward that people are going like, “When I get to the other side, then I’ll have them.” Again, our beliefs, biases, and various different fallacies about these different things the way money and debt work, we need a brain overhaul on this one.

There are a lot of mixed messages out there. There is a lot of misinformation. There are a lot of beliefs. Let me eliminate one example. Debt and credit certainly in business are necessary. In life, honestly, it’s necessary. It used to be that maybe our great-grandparents wouldn’t have had a mortgage to buy a house. They would have saved up and bought a house with money. I remember my grandparents telling me once that one house they owned when my father was a boy cost them $10,000. That was the price of the house. That was in Connecticut. That was pretty average in a house and not a trivial expense.

Getting a mortgage for that might have been unthinkable at one point. Now, no average American buys a home with cash, certainly not their first home. They’re going to need to borrow money from a bank a mortgage to get that. In order to be considered a safe risk-worthy of being granted approval for a mortgage, you have to have some experience with handling money, having been in debt, and paying it off. This is also true if you’re starting a business. If you want to borrow money as a company, 80% of the lending decisions for whether to loan your business money are based on your personal, as the owner of the business, credit profile, how you have behaved with borrowing money, and paying it back personally.

It is necessary to get credit cards to get a loan, whether it’s a car loan or a personal loan. There are strategies around getting into debt for the purpose of displaying good habits and behaviors around money and borrowing, paying it down, and not borrowing too much that makes you then an ideal candidate, “As a business, as a bank, whatever for your business, we will lend you money.” That’s one of the things. When you have a credit card, it’s fine to use it, but you want to keep that credit card balance somewhere no more than 30% to 40% of the total amount available to you. If you do that consistently and carry some debt, not a lot, then they want to give you more money. It’s when you’re out of credit, desperate for money, and need to get a loan or another credit card when then it’s very hard to do it.

Our national debt doesn’t work that way. The Federal Government, considering this infrastructure bill, I think it’s proposed at about $2 trillion of a package. We’ll see what it ends up being at the end of the day. Congress is going to pass that bill and the government is then instructed to borrow that money to be able to fund all the things that are in the bill. The idea being that’s going to put people to work. It’s going to help repair the infrastructure that allows all of our goods and services to be transported to and from us. That’s the plan anyway that it’s investing.

It’s going to come back around with the tax increase for the wealthy and corporate things because it went from 35% to 21% under President Donald Trump. Now, they’re bringing it back up to 23% or 27% or something like that.

I heard the original proposal was 28%, but it remains to be seen where it ends up. It’s still from the beginning of the Donald Trump administration when it was 35%, the tax is still going to have been reduced under the plan from what it was. What they’re trying to do is be fiscally responsible and say, “We’re borrowing this money to invest in America to put people back to work, but that’s going to be paid for by this increase in taxes on corporations, which is coming maybe not even halfway to what it was at the beginning of the Donald Trump administration.” The other benefit to the economy is all these people you put to work. Millions of more jobs of people getting paychecks and paying taxes.

They pay taxes on that amount. It is a dance. The economy does have a dance to it and taxes have a dance as they said, “It’s regrettable when individuals put the blinders on to say, ‘This way is best.’” Yet, it’s not in alignment with what the truth of the experience is for an entrepreneur who’s borrowing money to build a company. It’s different than a person who’s just going to spend the money. There are a lot of different things. It comes down to the word value. It’s like, “Does this debt have value to it?” If it does, then that’s called a moment of stability. If the debt has value, then it’s creating stability. “We need some economic stability showing up here.” That makes sense then.

“Where are we doing stability first in the health industry?” That was the COVID relief. It’s, “Here’s where that stability is. We’re going to create stability with these checks. We’re creating stability for the local governments here and to the state governments here. We’re creating stability over here. We’re creating stability for small businesses over here.” It’s creating stability so that the system can reboot and restart the flow of revenue in and out of these various different systems. The public system, the private system and capitalist system cannot operate by itself. They need each other to provide support in the way they approach the various different challenges and issues in the world. China is $1.06 trillion of the US debt and Japan is $1.28 trillion. The total foreign debt is $7 trillion.

It is not even a quarter of the national debt. Most of it is held by the US. That’s great. John Oliver is a comedian. Sometimes he does get a little political, but there was a good explanation there that was apolitical about debt and perspective.

One of the things that’s hard about this show is that even though you and I have certain beliefs that do get influenced with bias and might not be fully true, it’s when somebody says, hammers, and tries to make bigger the debt to China as a form of scaring others that, “We’re going to owe them and then what?” It’s like, “There’s no one then what.”

I heard one of them, “We’re going to be enslaved by the Chinese.” That was another one that was so hyperbolic and nowhere based on truth. It’s important to have perspectives around debt and what it means because it is a necessary tool of this capitalistic economy that we all live in. Let’s face it. This is a capitalist economy in the United States. It does take money a lot of times to grow business, accelerate business, create more jobs, and keep the engine of our country moving forward. Everything works better when the economy is growing. I have one other little perspective I’d like to throw in the mix here. It’s a different debt.

We talked about debt in the forms of stock or investors. There was a good example of a Silicon Valley company called Theranos started by Elizabeth Holmes. They were in the pharma and medical space, not producing drugs but producing lab tests. They were inventing and creating technology that you could, with a finger prick, get enough blood to do all sorts of lab tests that you’d have to traditionally go into like a Quest lab or somebody and get a lot of blood drawn. This company went from nothing to a $9 billion valuation before they’d sold anything or done any services, taking money from investors left and right.

This is the debt I’m talking about, getting to debt with investors and owing them. It all ended up being a fraud. It got a long way. It started on some promising technology, some invention that they believed was going to work. It didn’t end up working. The two key players in the company and its Owner, Elizabeth Holmes, who is a relatively young executive. She was speaking on stages everywhere at the time when it was still thought to be this wonderful thing that was happening. It was a big deal. They started to try to roll it out at pharmacies like CVS and things like that. It didn’t work. It was like this boulder that got rolling downhill that couldn’t be stopped because Elizabeth Holmes, the Owner, and one of her key executive cohorts were not truthful that it wasn’t working and continuing to get more investment, perpetuating the lie.

Eventually, it all came crumbling down. She is going to be on trial by the SEC and likely will spend a couple of decades in jail. That’s not the worst part of it. The worst part is all these people and funds that invested money that they got in debt to as a company for a stock. It’s a different debt. Again, you’re buying stock and ownership in a company. It’s risky. You’re hoping you get a return and there’s no guarantee, but it was also fraudulent. That’s a different thing, but it gives you an example of different perspectives on money, raising money to accomplish goals in government and business. These are very complex things.

While we see a person or an individual who’s weighing over their head in debt personally as a bad thing, that doesn’t mean that a business that gets into a lot of debt to achieve its goals is a bad thing. In fact, it’s how much of our economy works, nor does it mean if our government is going to get into debt for the greater good of allowing all these businesses to function and giving people jobs. Is that a bad thing? I’m not so sure of this.

There’s got to be a dance between the risk that we take and the growth that we would like to see. John Oliver mentioned this, but it’s also a lot of the things. If our growth is staying ahead of the interest rate, then that’s not a big problem because it’s ahead of the interest rate. John Oliver made a good point about that. It’s, “Our belief structures have got to keep evolving, changing, and adjusting. Think again, then think again, then have a new thought and think again.” Literally, it’s a part of that.

There’s a time when maybe you and I are 80 or 90, we’ll say, “Whatever, I don’t need to think again. All I got to do is watch and enjoy.” It’s still the process of think again. When a limiting belief crosses our path is going like, “That’s not true,” think again, “How am I going to move this into the outside world and create a moment of growth, change, or innovation to add to the mindset of managing expenses, and revenue and enjoy the show?”

The government and the politics are going to go back and forth trying to push the button of the voter. That’s the thing that I would like people to have awareness about. Watch how your buttons are getting pushed when your side or the other side is saying something. Watch it because those are your buttons that are getting pushed. Those are your need for truth, trust, respect, consideration, or fairness. Don’t let them push your fairness button. Don’t let them push your respect button because they’ll get you. There’s more to mention on this, Tom. This has been a good show to take a look at, “How do we adjust our belief structure to make it go better?”

Bill, thanks so much. I appreciate that.

Thanks, everybody.

Thanks, Bill.

Love the show? Subscribe, rate, review, and share!